Relative Strength Index (RSI) is a popular momentum oscillator

developed by J. Welles Wilder Jr. and detailed in his book New

Concepts in Technical Trading Systems.

The Relative Strength Index compares upward movements in closing

price to downward movements over a selected period. Wilder originally

used a 14 day period, but 7 and 9 days are commonly used to trade the

short cycle and 21 or 25 days for the intermediate cycle. Please note

that Wilder does not use the standard moving average formula and the

time period may need adjustment.

Relative Strength Index is smoother than the Momentum or Rate of

Change oscillators and is not as susceptible to distortion from

unusually high or low prices at the start of the window (detailed in

Momentum

Construction). It is also formulated to fluctuate between 0 and 100,

enabling fixed Overbought and Oversold levels.

See Construction

for further details.

Trading Signals

Different signals are used in trending

and ranging

markets. The most important signals are taken from overbought and

oversold levels, divergences

and failure

swings.

Use trailing

buy- and sell-stops to time entry into trades.

Ranging Markets

Set the Overbought level at 70 and Oversold at 30.

-

Go long when RSI falls below the 30 level and rises back above

it

or on a bullish divergence

where the first trough is below 30.

-

Go short when RSI rises above the 70 level and falls back below

it

or on a bearish divergence

where the first peak is above 70.

Failure

swings strengthen other signals.

Trending Markets

Only take signals in the direction of the trend.

-

Go long, in an up-trend, when RSI falls below 40 and rises back

above it.

-

Go short, in a down-trend, when RSI rises above 60 and falls

back below it.

Exit using a trend indicator.

Take profits on divergences.

Unless confirmed by a trend indicator, Relative Strength Index

divergences are not strong enough signals to trade in a trending market.

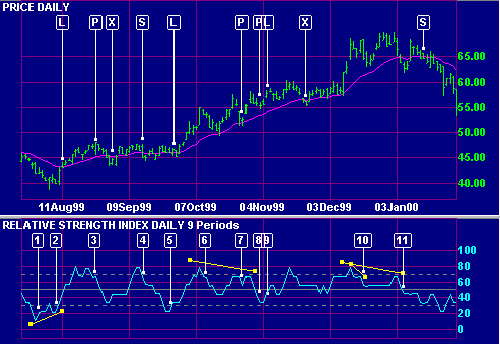

Example

Wal-Mart Stores Inc. is plotted with a fuchsia

21 day exponential

moving average (MA) and aqua

9 day Relative Strength Index. A 2-day closing filter

is used with the MA.

- Price is trending downwards (staying below the moving average). Do

not take long signals until the MA turns upward, otherwise we are

trading against the trend.

- A bullish divergence

on Relative Strength Index is reinforced by completion of a failure

swing at [2]. Go long [L] when the MA slopes upwards and RSI

crosses to above 40.

- RSI completes a minor failure swing at [3]. Take profits [P] and

exit the remaining position [X] when there are two closes below the

MA.

Do not go short as price is trending upwards (staying above the

moving average).

- Price has started to fluctuate around the moving average,

signaling a ranging market. Go short [S] when RSI crosses from above

to below 70.

- Go long [L] when RSI crosses from below to above 30.

- There has been a breakout from the trading range and price is

trending upwards. Do not close the long position.

- Take profits [P] on the bearish divergence (Price has completed a

higher peak while RSI has experienced a lower peak).

- Take profits [P]. A bearish triple

divergence is confirmed by completion of a large failure swing

at [8].

- Increase your long position [L]. RSI has crossed from below to

above 40 during an up-trend.

Exit your position [X] when there are two closes below the MA. Do

not go short as the MA still slopes upwards.

- A small bearish divergence warns of a possible trend reversal.

- A bearish triple

divergence is reinforced by completion of a failure

swing at [11]. Wait until the MA has turned down and RSI has

crossed to below 60 before entering a short trade [S].

Construction

The steps in calculation of the Relative Strength Index are:

- Decide on the RSI Period, based on the time

frame that you wish to analyze.

- Compare Closing price [today] to Closing price [yesterday].

- For the RSI Period, add all upward movements in Closing price.

- For the RSI Period, add all downward movements in Closing price.

- Calculate the exponential moving average* of price movements:

Average Upward Price Move = Exponential Moving Average of Upward

Movements

Average Downward Price Move = Exponential Moving Average of Downward

Movements

- Calculate Relative Strength (RS):

RS = Average Upward Price Move / Average Downward Price Move

- Calculate the Relative Strength Index (RSI):

RSI = 100 - 100 / ( 1 + RS )

Users should beware, when setting time periods for Welles Wilder's

indicators, that he does not use the standard exponential moving average

formula. For example, Wilder describes 1/14 of today's data + 13/14

of yesterday's average as a 14-day exponential moving average. If

you refer to Exponential

Moving Averages you will see the formula equates to a 27-day

exponential moving average.

Indicators affected are:

We recommend that users try shorter time periods when using one of

the above indicators. For example, if you are tracking a 30-day cycle

you would normally select a 15-day Indicator

Time Period. With the RSI, adjust the time period as follows:

RSI time period = (n

+ 1) / 2 = (15 + 1) / 2

= 8 days

Alternatively, select the Exponential moving average option (for RSI

or ATR) in place of the default Wilder moving average